(Photo : HedgeStone Assets)

(Photo : HedgeStone Assets)

A Broker with a difference

Are you a start-up or a small enterprise looking to maximize value of your savings? Or perhaps you are a salaried individual seeking to maximize the value of your savings. Perhaps you have exhausted yourself trying to find a platform that combines all your needs in one place. Your savings are languishing in banks with the bare minimum interest rate return. This is where you can take a look at HedgeStone Assets, a Colorado based trading platform.

HedgeStone at a glance

More Details about HedgeStone Assets

Regulation

HedgeStone Assets is tightly regulated by the Financial Conduct Authority. They strictly follow Anti-Money Laundering (AML), Know-Your-Client (KYC) and Combatting the Financing of Terrorism (CFT) regulations. Hence, your funds will never end up in the wrong hands or be used towards financing illegal activities worldwide.

Platform

HedgeStone Assets utilizes two different platforms. Webtrader, a web browser-based platform and their Mobile application, downloadable for iOS and Android. They understand that every client has unique needs, therefore, users can decide which platform they prefer. The webtrader platform is user friendly and easy to understand. Similarly, their mobile application is simple and quick to use. However, the mobile application does come with the downsides of clogging your phone's storage and draining your battery. Whereas for Webtrader, you will require a web browser to log in.

Trading Accounts

HedgeStone Assets offer six different types of trading accounts, each suited to unique client needs.

You can start trading with as little as $250, however, the disadvantage is their high commission's, ranging up to 7% for their basic trading accounts.

Trading Products

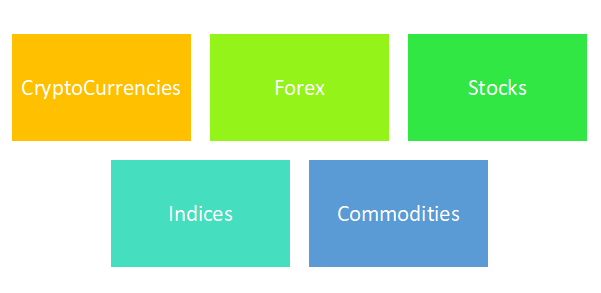

HedgeStone Assets ensures a variety of trade products at your fingertips. The following are the types of investment opportunities you can trade in if you choose HedgeStone as a broker:

Cryptocurrencies

With HedgeStone Assets, you can easily trade cryptocurrency CFDs such as Bitcoin, Ripple XRP, Ethereum by speculating on their price fluctuations. You don't even need to hold the currency, just speculate on its future price. Furthermore, there is no need for a specialized wallet or exchange account. And the best part? Its available 24/7 for ease of access.

Forex

HedgeStone Assets provides CFD trading on Forex pairs 24/7. Starting at 08:00 Sydney time on Monday and ending 16:00 New York time on Friday afternoon. With over seventy currency pairings available for CFD trading, this broker knows how to conduct good, valuable business.

Stocks

Simply put, an ownership into a company. Also known as equity or shares. HedgeStone Assets offers all the blue chip stocks at the touch of your fingertips.

Indices

Top indices from around the world are available for you to allocate your investments in. Such as S&P 500 (USA), DAX 40 (Germany), FTSE 100 (UK), all are available via your HedgeStone Assets account.

Commodities

Commodities are really lucrative for speculation. Top commodities such as crude oil, gold, coffee, wheat, corn and many more are accessible via HedgeStone Assets.

Is your investment safe with HedgeStone Assets?

Since they are tightly regulated by the Financial Conduct Authority, your funds are never at risk. Similarly, using state of the art end-to-end encryption for client data, your data and privacy are maintained at all times. No third parties will ever have access to any of your information. Therefore, your funds and your identity are safe with HedgeStone Assets.

Final Verdict: Where HedgeStone Shines and Where it Falls Short

Best features

HedgeStone is overall a great platform for small, medium and large investors seeking to maximize the value of their savings. Their six different types of accounts based on individual investment needs and minimum deposit value are definitely a plus point. Clients have the freedom to choose between a mobile application or a web browser or even use both!

Downsides

HedgeStone charges high fees for trade for small accounts. With fees going upto 7% for a novice account, it might not be the best option for individuals for whom every penny counts.

Furthermore, their website states that 72.54% retail investor accounts lose money while trading with HedgeStone Assets, which means that the risk is high with this broker.

Overall

HedgeStone may be a pricey platform but comparing it with other providers, it seems to be a reasonable choice for a standard investor.