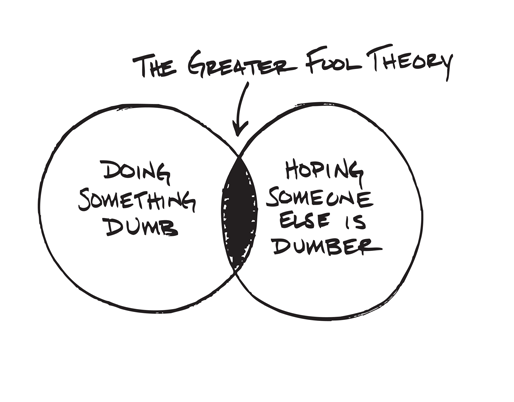

The greater fool theory refers to the idea that it can be profitable to buy overpriced assets and then sell them at an even higher price to the so-called "greater fool." In other words, it's a term to explain how the price of something can rise continuously even if the intrinsic value of the asset has not changed.

This theory has been studied extensively by economic experts. It occurs in all fields, including stocks, real estate and cryptocurrency. It can cause inflation and general price volatility.

Sometimes in crypto circles this activity is referred to as chasing green candles. The term is in reference to the rising green lines on price charts. Scientists say this behavior is the result of crowd psychology. People are generally excited by rising prices. They see that others have sold an asset and made a profit, so they assume they can do the same thing. This strategy tends to work well until the bubble pops and someone loses money.

While the general strategy for investing in cryptocurrency is "buy low and sell high," the greater fool strategy is more like "buy high, sell higher." This can lead to serious profits while prices are pumping, but it is tremendously risky.

The Risks of Becoming a Greater Fool

This risk is why some prefer the term "greater fool bubble." When an asset keeps being sold for higher and higher prices, eventually someone will be unable to sell it for a higher price.

In extreme cases, the greater fool will be unable to sell even at a lower price. This can happen when the price of a cryptocurrency suddenly crashes to zero or near zero. In these cases, the greater fool's purchase is reduced to a total loss. In crypto circles, this is commonly referred to as holding one's bags. It refers to the image of a person tightly holding onto bags which once were full of money, but now are empty.

When prices are pumping, it's impossible to tell who will end up being the greater fool. All that is certain is that someone will end up being one. Some people have become rich by selling crypto tokens to the greater fool, while others have gone bankrupt. Some have gone from rags to riches to rags again. Since most cryptocurrencies are incredibly volatile, these greater fool scenarios are somewhat common.

When Greater Fool Theory Makes Sense

When is utilizing the greater fool strategy more likely to succeed? During a bull run, of course! When the market is doing well and people are feeling optimistic, it's easier to buy crypto and flip it for a profit. In contrast, sluggish bear markets make it difficult to sell coins for higher prices.

The greater fool strategy works best with small amounts of money. This reduces the risk of becoming the greater fool in the event of a crash or market correction. Using the greater fool strategy with small amounts of money is like gambling. Small amounts of wealth are put on the line in exchange for the much larger possibilities.

Consider the stories of ordinary people who got lucky and became millionaires after investing in cryptocurrency. Many of them gained their riches by selling their crypto to someone else rather than just converting to fiat. For them, it was profitable.

The Problem with Greater Fools

Of course, for every person who got rich selling to the greater fools, there is a person who got the short end of the stick. In these sorts of markets, some people are doomed to end up the great fools themselves. These people are lucky to even make it. Most will sell at a loss.

Crypto investors with large sums of money should not use greater fool strategies. Since they have more money, there is much more to lose. Likewise, anyone interested in more stable, long-term investments should stick to more conservative strategies. Investing in asset-backed stablecoins is one way to invest in cryptocurrency without being subjected to volatile price jumps.

The greater fool cycle is one reason critics often accuse cryptocurrency as a whole of being a bubble. They see some people buy seemingly high-value tokens that end up being worthless. This fuels the misplaced perception that all cryptocurrencies are just scams.

While the risk of becoming a greater fool is terrible, the good news is that it is also completely avoidable. Greater fools are common among day traders. Using tried and true strategies like dollar cost averaging can help an investor avoid excessive risk.

One can also avoid becoming a greater fool by thoroughly researching a crypto asset before investing in it. Rugpulls tend to result in many fools. Lately there have been a ton of notable rugpulls, however, they can be avoided by sticking to projects with long histories and known developers. Trustworthy projects are less likely to end in the sudden crashes that create bag holders or fools.

Conclusion

Risky buying and selling patterns can be tempting for new investors, but anyone who has done their own research should know how to avoid becoming a greater fool. There's a good reason why seasoned crypto investors do not chase green candles. They know better than to become the greater fool.