Technology is the foundation on which the modern world is built. Many luxuries of human life would've never been possible without advanced technological advancements. Besides making our lives easier, tech innovations have also transformed various industries, from healthcare and manufacturing to retail and entertainment.

While tech companies do most of the groundwork, venture capitalists are the driving force behind them. Most startups would struggle to continue innovating and building new products without adequate venture investments.

To Tmcnet, VC David Kezerashvili said "Venture investments are the fuel that helps tech startup founders continue with the research and innovation cogwheel. VC funding gives them a competitive edge that isn't achievable through advertising campaigns and sales strategies ". Kezerashvili is not alone. Venture capitalists have always had a soft spot for tech companies. Tech startups accounted for a majority of venture investments in the last decade.

An Ever-Growing Interest in Tech Startups

The COVID-19 pandemic further bolstered VCs' interest in tech. It resulted in a two-fold increase in investments from Q1 2020 to Q1 2022. Also, more than 70% of VC funding went to tech startups in Q1 2022.

The growing VC interest in the tech industry isn't surprising, considering that technology has become ingrained in the "new normal." Hospitality, healthcare, real estate, transportation - every industry has had to adopt tech innovations to overcome unique challenges posed by the ongoing pandemic.

For instance, many companies have struggled with supply chain disruptions and logistical roadblocks due to pandemic-driven restrictions. That compelled VCs to invest more than $45 billion in industrial tech startups that are developing solutions to overcome these challenges.

These companies specialize in using advanced technologies, such as artificial intelligence, data analytics, and edge computing, to mitigate or resolve supply chain bottlenecks.

AI-powered supply chain solutions aren't the only innovations that have caught the attention of VCs. Here are a few other technologies that are garnering significant traction and funding from venture capitalists:

AI/ML

Artificial intelligence (AI) and machine learning (ML) are some of the most promising new technologies that are taking various sectors by storm. It's only natural that VCs are keen to harness that trend with strategic investments in startups building AI/ML solutions.

Instead of settling for one-size-fits-all applications, investors are looking for AI/ML-powered solutions that address the challenges of specific industries. Venture investments in this sector could revolutionize various industries.

For instance, healthcare organizations can use AI/ML tools for advanced diagnostics and drug discovery. Similarly, the transportation sector can use AI/ML algorithms to power autonomous vehicles and robo-taxis.

Venture investments in AI/ML are ushering in an era of increased accuracy, efficiency, and productivity for every industry.

Cloud Computing

Much like artificial intelligence, cloud computing has applications in almost every sector, from manufacturing to retail. VCs are actively investing in horizontal cloud-based SaaS solutions, such as productivity tools and business intelligence software. These investments can go a long way to transform the way modern enterprises operate.

Also, VCs keep an eye out for technologies that enable cloud solutions. These include cybersecurity and data transfer tools. Backing companies that build these tools will create a future where companies have access to more sophisticated SaaS applications.

Venture investments in cloud computing will be one of the crucial driving factors behind the digital transformation of new-age enterprises. The availability of more advanced cloud-based solutions will ensure a seamless transition.

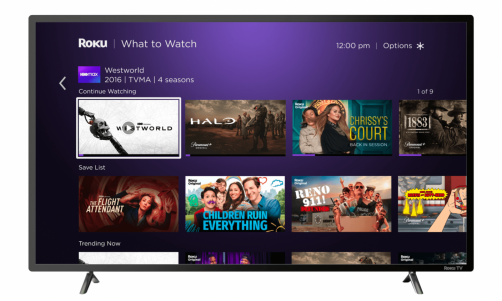

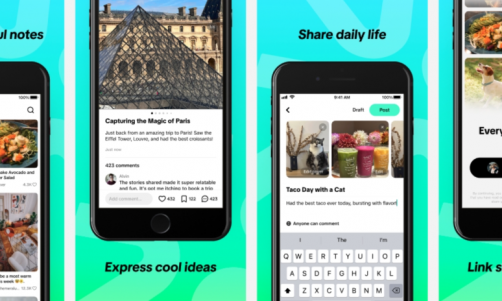

Video Technology

Business owners, product developers, marketers, and sales managers have realized the potential of videos. That has motivated VCs to back established and emerging video technologies.

There's been a growing interest in backing tech startups developing new augmented reality (AR) and virtual reality (VR) solutions. Also, they're funding startups in the video distribution and analytics space.

The rise of sophisticated video creation and delivery tools will transform the way companies approach marketing and sales. Also, it creates room for the development of cutting-edge video-based security solutions. That, in turn, could be beneficial for financial institutions, hospitals, assisted living facilities, and government agencies.

Building Tomorrow's Tech

Venture capitalists aren't only backing new technologies. They're investing in a better future where organizations can achieve breakthroughs in efficiency and cost savings through tech innovations.

That, in turn, will lay the foundation for consistent economic growth, generating more employment opportunities and tax income for the government. It makes venture investments an indispensable part of the startup landscape and modern society at large.