According to a new study by Counterpoint Research, Apple's iPhone 16 was the best-selling smartphone in the first quarter of 2025.

Sure, we're all used to Apple's iPhones topping the sales charts, especially the latest models, but it's typically the Pro models, like last year when the iPhone 15 Pro Max took the top spot.

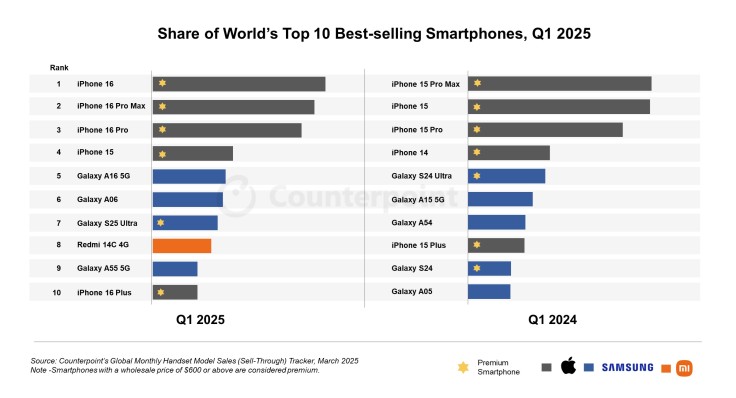

This year, however, the base model iPhone 16, followed by the iPhone 16 Pro Max, then the iPhone 16 Pro, and then the last-gen iPhone 15, takes the top spot. Only then do we see non-Apple smartphones, with Samsung's Galaxy A16 5G and the Galaxy A06 taking positions five and six, respectively. It's not until slot seven that Samsung's flagship series gets a nod, with the Galaxy S25 Ultra.

In Q1 2024, the iPhone 15 Pro Max was the best-selling smartphone, indicating a consumer preference for premium models last year. The shift back to the base model's dominance in 2025 suggests changing consumer priorities, possibly influenced by economic factors and regional market dynamics

The iPhone 16's strong performance was notably driven by increased sales in Japan and the Middle East and Africa (MEA), said Counterpoint, regions where improved economic conditions and revised subsidy regulations favored Apple's pricing strategy.

This pattern underscores the impact of regional economic factors and product positioning on smartphone sales trends.

The Galaxy S24 Ultra, Samsung's flagship from last year, took spot five in 2024's analysis, showing a drop of two spots in the intervening time period. Interestingly, Samsung's non-premium models moved up in the ranks, as did Xiaomi's new Redmi 14C 4G.

"Most of [Redmi's] sales came from emerging markets, particularly the MEA and LATAM, underscoring Xiaomi's strength in value-driven segments," wrote the research team.

The researchers noted that even with the uncertainty around tarriffs, the share of the top 10 best-selling smartphones is expected to stay relatively stable as customers continue to look for premium features in their purchasing decisions.

Originally published on Tech Times