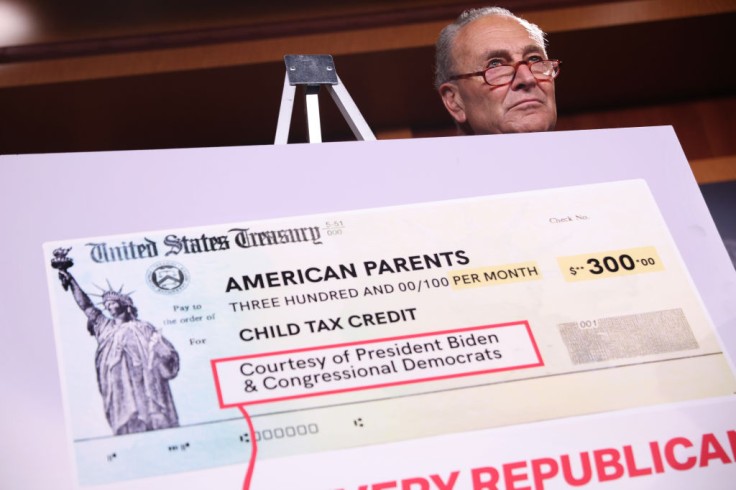

Millions of families should have received their $300 child tax credit payment by now. Instead, many have reported their money missing. To help validate these payments, IRS released an online tool to help you check your eligibility status.

The IRS already sent two waves of advance child tax credit payments on July 15 and August 13. Unfortunately, even with delivery delays, many families never received either of these payments. By now, it is recommended that you re-check your eligibility status on the child tax credit, so you could decide whether you should file a payment trace.

Fortunately, the online tool "Advance Child Tax Credit Eligibility Assistant" is available. This is a highly intuitive tool that would automatically determine your eligibility after receiving the necessary information.

How to Check Child Tax Credit Eligibility with IRS Online Tool

To use the "Advance Child Tax Credit Eligibility Assistant," head to this website and click on "Check Your Eligibility."

Afterward, you will be asked a few general questions about your tax returns and residency. The online tool will automatically notify and block the next steps if you do not qualify for the child tax credit. If you qualify, click "Next" to proceed.

If you previously submitted your 2020 tax returns, then the online tool would automatically skip to "Step 3." If you have not submitted, then you would need to proceed to "Step 2" where you must provide your "Status & Income," as well as the number of "Qualifying Children" with their respective age. Do not skip any of the boxes to avoid receiving the error message. Click "Next."

"Step 3" will showcase the full results of your eligibility status. This report will also explain how much payment you could receive depending on children's eligibility and your current AGI.

Lastly, near the bottom, the online tool will offer to:

- Find out if you are enrolled in the ongoing payments: "Manage Your Advance Child Tax Credit Payments."

- Find out how advance payments could affect your 2021 tax return: "Get Details About the Changes."

Note that the Child Tax Credit Eligibility Assistant works in different languages, including Spanish. This should help others who are struggling to translate the English language.

Read also: The True Story Behind the Instagram 'Nah He Tweakin' Meme: Who Started the Viral, Annoying Comment?

How to Use Child Tax Credit Portal

A second tool you can use to check on your ongoing payment is the Child Tax Credit Portal. This is helpful to people who want to:

- Check on their child tax credit payment status

- Check on the amount receivable from the child tax credit

- Opt-out of the monthly payments and receive the child tax credit money in one lump sum

- Update mailing address

- Update bank account information

For eligible families who have already filed their tax returns, you do not need to take action for your child tax credit money. Your account would automatically be included in the IRS budget. Unfortunately, Cnet reported that the IRS is experiencing delays in its delivery. The tax agency recently encountered an issue that forced them to deliver the August 13 payments by snail mail, which would take until next month.

Related Article: Fourth Stimulus Check Update: $2000 Petition Set for Massive Milestone!